Part 1- Best Practices in Nonprofit Special Events Reporting: Guidelines to Increase Clarity and Consistency

Part 1: Key Issues

Public charities holding special events are entrusted by donors and the general public to report the financial results of their fundraisers both accurately and transparently. To do that, charities must understand the complex and sometimes counterintuitive rules and regulations that govern financial statement and tax return reporting under GAAP and IRC.

GAAP reporting requires special events revenue to be bifurcated from general contribution revenue because special events revenue is often comprised of not only a contribution component but also an exchange transaction. Whereas, under IRC rules, revenue from special events is distinguished from contribution revenue because taxpayers’ charitable deductions are limited to the amount donated in excess of the value of benefits received.

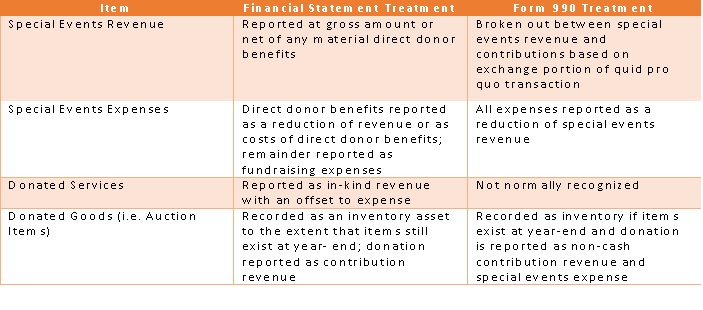

The table below highlights the major reporting differences under GAAP and IRC:

Special Events Revenue

For nonprofits whose fundraising event revenues are a central and ongoing component of total revenue, special events revenue is reported at either the gross amount or net of direct benefits to donors in a “quid pro quo transaction”[2], depending on how significant those benefits are [FASB ASC 958-225-45-17]. When they are significant, they can either be reported as a reduction of special events revenue under revenue and support or in a separate expense category classified as ‘costs of direct benefits to donors’. When fundraising event revenues are an insignificant component of total revenue, special events revenue can be reported net of direct donor benefits.

This is distinguished from IRS Form 990, where special events revenue is reported at the value of the benefits received by the donors (i.e. the “exchange” portion of the transaction), with amounts contributed in excess of the value received reported as contributions.

Special Events Expenses

The reporting of special events expenses features as many nuances as that of special events revenue. Under FASB ASC 958-225-55, special events expenses that do not represent costs of direct donor benefits are typically presented as fundraising expenses on the statement of activities and changes in net assets.

For tax return reporting, all special events expenses including costs of direct donor benefits and other direct expenses are reported as a reduction of special events revenue. Schedule G further breaks out direct expenses that do not represent costs of direct donor benefits between cash prizes, noncash prizes, venue costs, food and beverages, entertainment costs, and other costs. This presentation is important to highlight, as charity watchdog groups, such as Guidestar and Charity Navigator, derive their data from public charity tax returns for its analysis and ratings. Because of this, an organization with a high level of special events expenses will have a significantly more favorable efficiency ratio on its tax return than on its financial statements.

Donated Services

Another key difference involves the treatment of donated services related to special events. On the statement of activities of the financial statements, the value of donated services is reported as in-kind contribution revenue with an offsetting increase to fundraising expenses. This contrasts with tax return reporting whereby the value of donated services is typically excluded. One exception to this rule is for donated services auctioned at special events which are treated as non-cash contribution revenue. This can trigger a public perception issue in that an organization’s efficiency ratio may appear low because those donated services are included in total expenses but excluded from program expenses. As highlighted above, nonprofits should understand that such costs are excluded from reporting on Form 990, which generally serves as the basis for charity watchdog ratings.

Donated Auction Items

One other significant inconsistency between financial statement and tax return reporting involves the treatment of donated auction items. Donated auction items are reported as inventory on the statement of financial position of the financial statements to the extent that they still exist at year-end. The donation of an auction item is normally recognized as contribution revenue with any proceeds received above the value recognized as contribution revenue. If actual proceeds are less than the value, the difference reduces contribution revenue.

This treatment contrasts with tax return treatment of donated auction items, which are recognized as non-cash contributions as well as non-cash special events expenses on Part VIII of Form 990 and Schedule G. Any auction items still on hand at year-end are also recognized as an inventory asset, assuming they will be used for future special events.

Another public perception issue that can impact certain public charities is that the bottom line reported on Schedule G of Form 990 (as well as line 8c of Part VIII) can be negative, which would suggest that a charity actually lost money at its fundraiser(s). This apparent loss is artificial, however, as the bulk of the income from most special events (i.e. the contribution portion) is subtracted from both Schedule G and line 8 of Part VIII and reported as part of contribution revenue on line 8 in Part I of Form 990. This presentation is counterintuitive and may prompt questions from prospective donors as to why special events have generated losses. Any concerns can be alleviated if an explanation is provided in Schedule O of Form 990 to indicate that total amounts raised from special events (i.e. line 1 of Schedule G) represent the true “gross revenue” amount received before subtracting out expenses. This can go a long way in helping prospective donors evaluate the success or failure of a charity’s special events.

Footnotes:

[2] quid pro quo transaction – transaction whereby a donor contributes an amount in exchange for direct benefits. A common example is special event revenue. The cost of benefits received is treated as special events revenue with the excess treated as contributions revenue.

Read the introduction to this four part series here.

Posted In: Articles